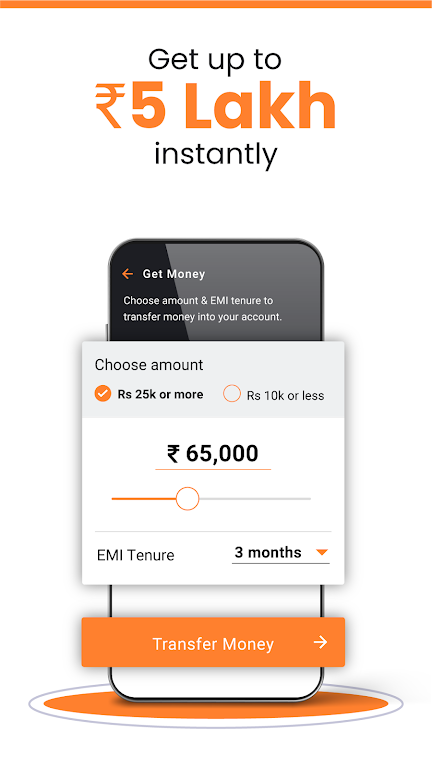

MoneyTap - Credit Cards & Loan is a revolutionary app that provides instant credit cards and loans to salaried employees in India. With this app, you can get approval for credit up to ₹5,00,000 and only pay interest on the amount you withdraw from your balance. What sets MoneyTap apart from other loan apps is its flexibility. You can borrow any amount starting at ₹3,000 and pay interest only on the amount you actually use. The entire process is digital and paperless, ensuring a hassle-free experience. Plus, you can select flexible EMIs and pay later. With low processing fees, interest rates as low as 12%, and a minimal one-time setup fee, MoneyTap is the best instant personal loan app in India. To apply, you only need your Aadhaar number, identity proof, address proof, and a passport-sized photo. Say goodbye to financial stress and embrace the flexibility and convenience of MoneyTap.

Features of MoneyTap - Credit Cards & Loan:

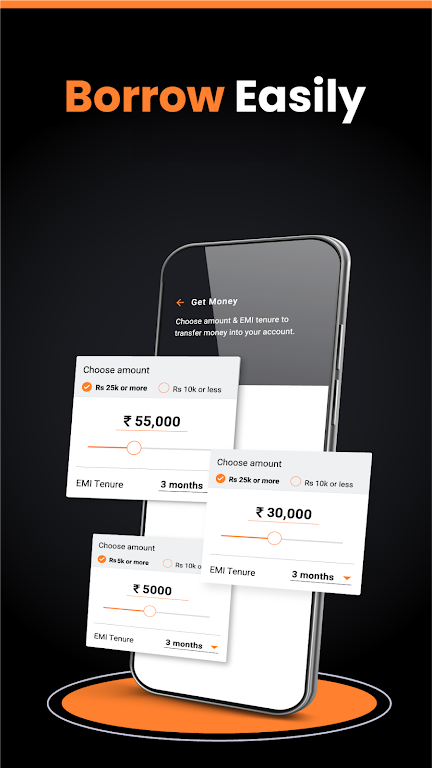

Borrow any amount: MoneyTap allows you to borrow any amount of money starting at ₹ 5,00,000 up to ₹5 lakhs from your approved credit limit. This flexibility ensures that you can access the funds you need, whether it's for a small expense or a larger financial need.

Pay interest only on the amount you use: With MoneyTap, you only pay interest on the amount of money you withdraw from your approved credit limit. This means that if you don't use the entire credit limit, you won't have to pay interest on the unused portion.

Instant personal loan without any risk: MoneyTap offers instant approval for credit up to ₹5 lakhs. This eliminates the hassle of lengthy approval processes and allows you to access the funds you need quickly. Additionally, since you pay interest only on the amount you use, you can manage your repayments easily without incurring unnecessary debt.

Fully digital, paperless experience: MoneyTap provides a fully digital and paperless experience. You can apply for a personal loan, submit the required documents, and complete the entire process online, saving you time and eliminating the need for physical paperwork.

Tips for Users:

Determine your borrowing needs: Before using MoneyTap, assess your financial needs and determine the amount of money you require. This will help you borrow an appropriate amount and avoid borrowing more than necessary.

Understand the interest rates and fees: Familiarize yourself with the interest rates, processing fees, and setup fees associated with your personal loan. Understanding these costs will help you plan your repayments and avoid any surprises.

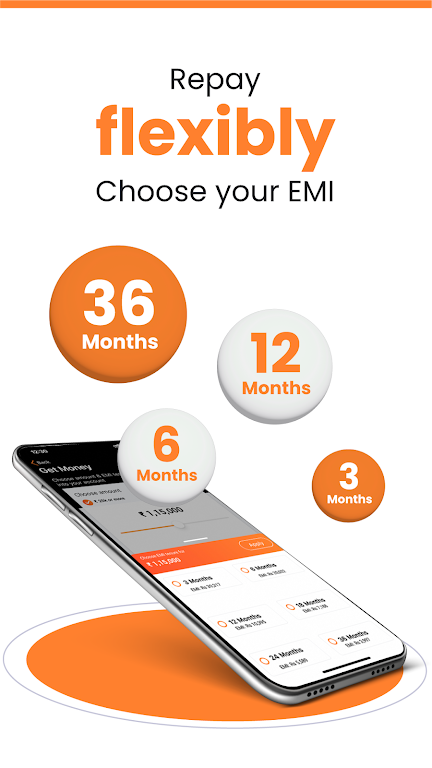

Choose flexible EMIs: MoneyTap allows you to select flexible EMIs (Equated Monthly Installments) based on your repayment capabilities. It is advisable to choose an EMI amount that comfortably fits within your budget to ensure timely repayments.

Conclusion:

MoneyTap - Credit Cards & Loan stands out as the best instant personal loan app in India due to its standout features such as flexible borrowing options, interest-only payments, instant approvals, fully digital experience, and flexible repayment options. Whether you need a small amount for an emergency expense or a larger sum for a planned purchase, MoneyTap provides a convenient and hassle-free solution. By understanding the terms and fees, and making responsible borrowing decisions, you can utilize MoneyTap to fulfill your financial needs effectively. Download the MoneyTap app today and experience the benefits of instant personal loans in India.

Category: Finance Publisher: MoneyTap.com File size: 60.20M Language: English Requirements: Android Package ID: com.mycash.moneytap.app

Recommended

Reviews

-

They have ended partnership with cholamandalam(as per my knowledge).Now existing customers like me r unable to take loan from already alloted credit limit.Now India lends is their new partner and no loans r given by them..(my experience).My credit line amount is also not shown in the APP2024-08-15 23:47:49

-

Worst experience.taken all documents and not provided loan.simply fake app I think so.2024-08-13 19:31:59

-

Worst app auto setup not working showing error every time and no response from customer side2024-08-13 18:25:21

-

Time to remove from playstore . Fake promises, scam phishing message, creditline not working.2024-08-12 19:15:35

-

Most worst app , I have submitted all the necessary documents for ENach, till today it was not happenned and no Customer care support .worst worsen and worstest2024-08-12 00:36:59

-

This app is fake everytime this app checking credit report and stuck not provide any offer and keep masseging applied loan what a froud app don't trust this app2024-08-11 08:54:57