Looking for affordable loans tailored to the needs of veterans? Introducing VVA Loans - FAQ & Tips, a game-changer in the lending industry. What sets us apart is our unwavering commitment to providing accessible and affordable loans to veterans. With lower interest rates and flexible repayment options, Ve Loans puts your financial well-being first. Our quick and easy online application process ensures a hassle-free experience, with no hidden fees or prepayment penalties. Whether you're a veteran looking to consolidate debt or manage your finances more effectively, Ve Loans has got you covered. Compare and contrast our benefits with traditional loans and witness the difference firsthand. Don't miss out on the opportunity to level up your financial situation with Ve Loans.

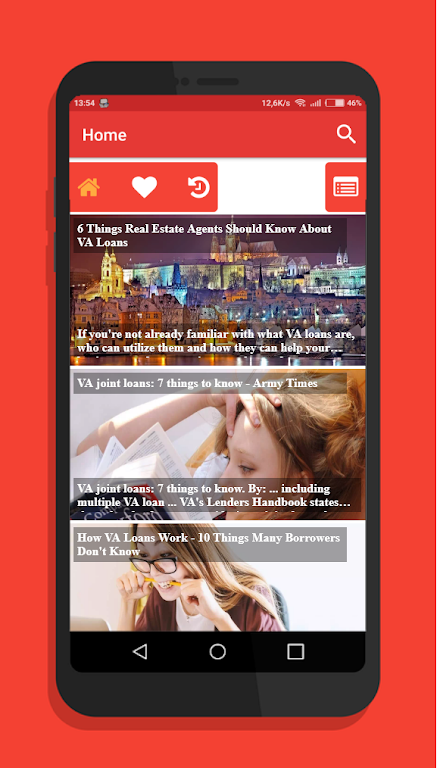

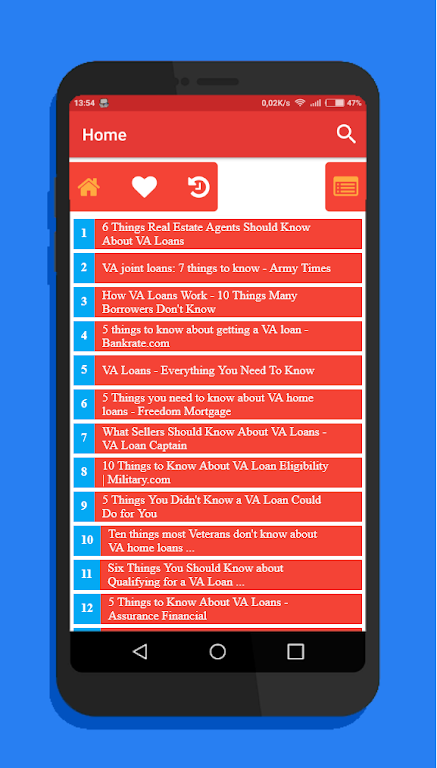

Features of VA Loans - FAQ & Tips:

Lower interest rates and flexible repayment options: Ve Loans offers veterans the benefit of lower interest rates compared to traditional loans. This provides them with more affordable monthly payments and the flexibility to choose a repayment plan that suits their financial situation.

Quick and easy online application process: Ve Loans understands the importance of accessibility and convenience for veterans. Our online application process is designed to be user-friendly and streamlined, allowing veterans to apply for a loan from the comfort of their own homes.

No hidden fees or prepayment penalties: Unlike some loan providers, Ve Loans is transparent about its fees and penalties. Veterans can rest assured that there are no hidden costs associated with their loan, and they have the freedom to pay off their loan early without any additional charges.

Playing Tips for Ve Loans:

Prepare your documents and information in advance: Before starting the application process, gather all the necessary documents and information that may be required, such as proof of military service, income statements, and identification documents. This will ensure a smooth and efficient application process.

Compare loan options: While Ve Loans offers competitive rates and terms, it is always a good idea to compare different loan options available to veterans. Consider factors such as interest rates, repayment terms, and customer reviews to make an informed decision.

Create a budget: After receiving a loan from Ve Loans, it is important to create a budget to manage your debt effectively. This will help you allocate your funds wisely, make timely payments, and avoid falling into further financial hardship.

Conclusion:

VA Loans - FAQ & Tips is the go-to platform for veterans in need of affordable loans. With its lower interest rates, flexible repayment options, and transparent policies, Ve Loans stands out as a reliable and accessible lending solution for veterans. The quick and easy online application process, along with the absence of hidden fees or prepayment penalties, further enhances its appeal. By following the provided playing tips, veterans can make the most of their Ve Loans experience and effectively manage their debt. Browse, click, and download Ve Loans now to take advantage of its numerous benefits.

Category: Finance Publisher: Things To Do File size: 8.80M Language: English Requirements: Android Package ID: com.proyectoultra70