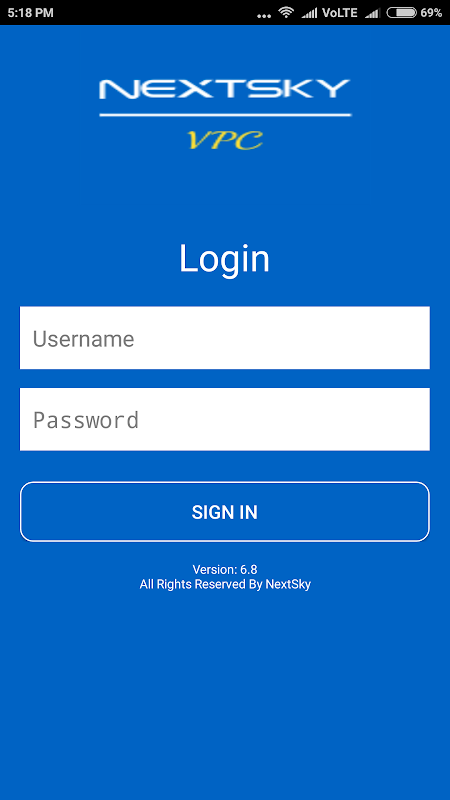

Nextsky VPC Third-Party Verification (TPV) ensures the accuracy and intent of customer information by having it reviewed and confirmed by an external organization. This is especially useful for sales and loan departments as it allows them to verify a potential customer's interest before connecting them with a salesperson. Under the Customer Profile Validation (CPV) vertical, it offers a range of verification services such as address, tele, and document verification to both banking and non-banking sectors, including insurance.

Features of Nextsky VPC:

I. Comprehensive Verification Services

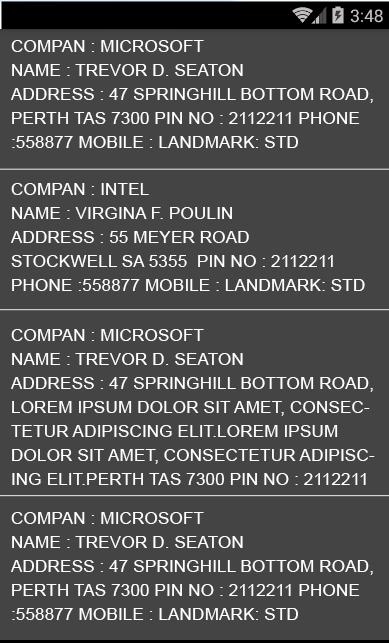

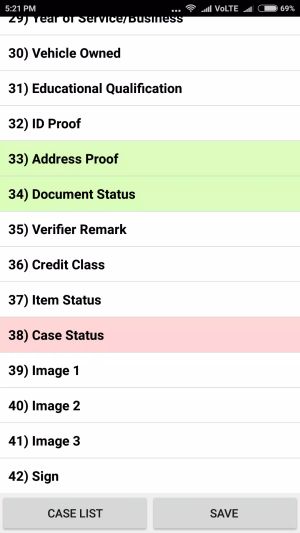

It offers a wide range of verification services under its Customer Profile Validation (CPV) vertical. These services include residence address verification, business confirmation, and document verification. By providing these comprehensive services, it ensures that the verification process is thorough and accurate, giving businesses peace of mind.

II. Trusted Third-Party Verification

It utilizes third-party verification to ensure the accuracy and integrity of customer information. By having an outside organization review customer information, it confirms the customer's intent and validates the accuracy of the data. This trusted verification process is commonly used in sales and loan departments, providing an extra layer of assurance.

III. Industry-Specific Expertise

It specializes in serving the banking and non-banking sectors, as well as the insurance industry. With a deep understanding of these industries, it is equipped to handle a significant volume of credit cards, know your customer (KYC) processes, and retail asset products. This industry-specific expertise allows it to tailor its verification services to the unique needs of each sector.

IV. Prompt Turnaround Time

It understands the importance of time in business operations. With a focus on efficiency, the company guarantees a reasonable turnaround time (TAT) for its verification services. From case allocation to case closure, it strives to minimize the total time taken, ensuring that businesses can proceed with their operations without delay.

FAQs:

⭐ How does it conduct residence address verification?

It utilizes various methods to verify a customer's residence address, including visiting the address and confirming it with the customer. The company may also cross-reference the information with reliable databases to ensure accuracy.

⭐ What documents are typically involved in the document verification process?

The document verification process by it involves validating the authenticity of documents provided by the customer. This can include identification documents, proof of address, financial statements, and other relevant paperwork.

⭐ Can it handle high volumes of verification processes?

Yes, it is equipped to handle significant volumes of verification processes, especially in the areas of credit cards, KYC, and retail asset products.

⭐ How long does it take for it to complete the verification process?

Nextsky VPC guarantees a reasonable turnaround time for its verification services. The exact duration may vary depending on the complexity and scope of the verification required.

Conclusion:

Nextsky VPC offers comprehensive verification services, specializing in residence address verification, business confirmation, and document verification. By utilizing trusted third-party verification and leveraging industry-specific expertise, it ensures accurate and reliable results for businesses in the banking, non-banking, and insurance sectors. With a focus on prompt turnaround time, it minimizes delays in business operations. Partnering with AG Professionals Pvt. Ltd., it combines its expertise with a reputable and reliable partner to deliver top-notch verification services.

Category: Finance Publisher: Nextsky Technologies Pvt. Ltd File size: 1.60M Language: English Requirements: Android Package ID: com.sky.isandeep.nextsky