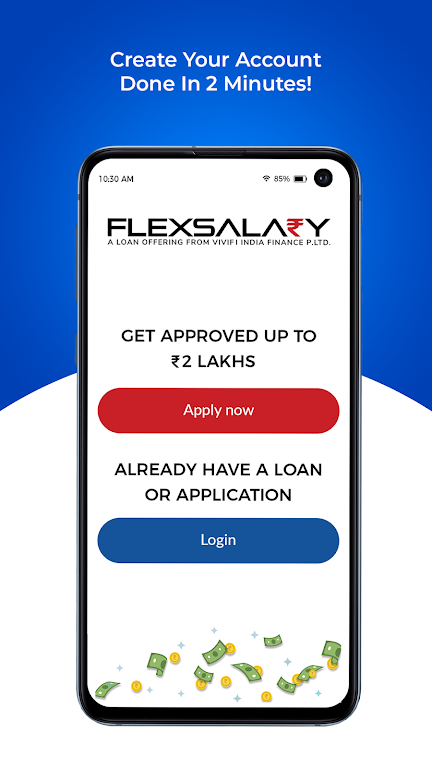

FlexSalary Instant Loan App is a convenient and accessible solution for those in need of quick and flexible cash loans in India. With a maximum credit limit of ₹3 lakh, this app caters to salaried individuals who require instant funds. With a wide range of Annual Percentage Rates (APR) from 19% to 55%, borrowers can choose an option that best suits their needs. The loan tenure ranges from 10 to 36 months, allowing borrowers to comfortably repay their loans. Additionally, the app boasts user-friendly features such as no late fees, no bounce cheque fees, and no prepayment penalties.

Features of FlexSalary Instant Loan App:

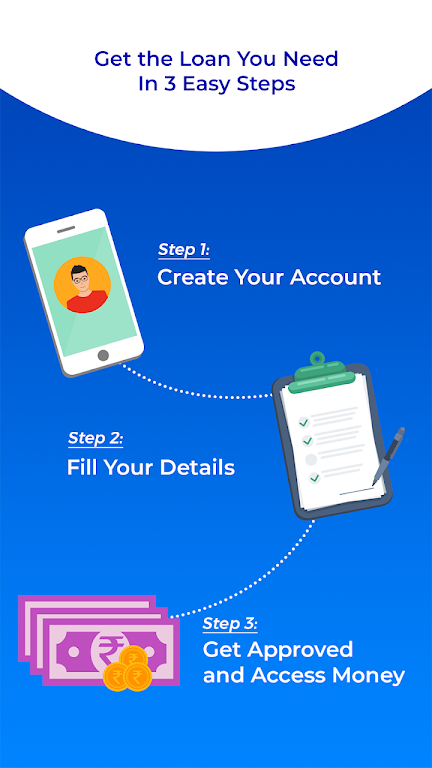

> Instant Loan Approval: It provides instant loan approval, allowing users to access the funds they need quickly and efficiently.

> Flexible Repayment Options: Unlike traditional loans with fixed EMIs, FlexSalary offers flexible repayment options, allowing users to repay the loan in a way that fits their financial situation.

> No Hidden Fees: It transparently states its fees and charges, ensuring that users are fully aware of the costs associated with the loan.

> User-Friendly App: It aims to be one of the most user-friendly personal loan apps in India, providing a seamless and hassle-free borrowing experience.

Tips for Users:

> Know Your Eligibility: Before applying for a loan, it is essential to understand the eligibility criteria. Make sure to check if you meet the requirements to increase the chances of loan approval.

> Compare Loan Options: Before making a decision, compare different loan options to find the one that offers the most favorable terms and conditions.

> Use the Loan Responsibly: Only borrow the amount you need and ensure that you can repay it comfortably within the specified tenure.

> Utilize the Flexible Repayment Options: Take advantage of the flexible repayment options offered by FlexSalary to create a repayment plan that aligns with your income and expenses.

Conclusion:

FlexSalary Instant Loan App's instant loan approval, flexible repayment options, transparent fees, and user-friendly app make it an attractive choice for individuals in need of fast personal loans in India. By following the playing tips of understanding eligibility criteria, comparing loan options, borrowing responsibly, and utilizing the flexible repayment options, users can make the most out of their borrowing experience. Whether it's for emergency cash needs or any other financial requirement, FlexSalary provides a convenient solution for quick and efficient loan approval.

Category: Finance Publisher: VIVIFI INDIA FINANCE PVT. LTD. File size: 35.90M Language: English Requirements: Android Package ID: com.flexsalary