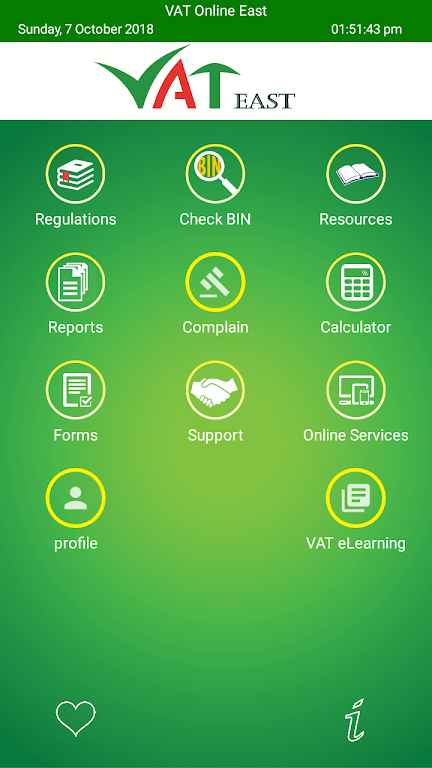

Introducing VAT East, a mobile app designed to assist consumers, taxpayers, tax officials, and procuring entities in various areas. With the ability to check the authenticity of VAT registration numbers, users can verify whether a BINeBIN is active or suspended, locked or cancelled, identifying whether a taxpayer is trustworthy or risky before engaging in business. Additionally, consumers can use the app to lodge complaints against a taxpayer, receiving feedback and potential financial rewards for reporting tax evasion. The app also provides a helpful feature to locate the nearest VAT office and offers compliance reminders to ensure timely submission. Users can access regulations, compliance guides, and contact details for VAT consultants, agents, and support centers. VAT East supports the needs of taxpayers and fosters transparency and compliance in tax processes.

Features of VAT East:

* BIN Check: Users can easily verify the status of a VAT registration number, which helps determine the trustworthiness of a taxpayer before engaging in business transactions.

* Complaint: The app allows users, specifically consumers, to file complaints against taxpayers. They will receive feedback from the VAT office and may even be rewarded for providing accurate information on tax evasion.

* Find VAT Office: Users can conveniently locate the nearest VAT office under Dhaka East VAT Commissionerate. The app provides directions to the required office, ensuring ease of access for taxpayers.

* Compliance Alert: The app sends notifications and SMS reminders to taxpayers who forget to submit their monthly VAT or quarterly ToT returns. This feature helps users stay on top of their compliance responsibilities.

* Compliance Acknowledgement: After submitting their VAT or Turnover Tax returns, taxpayers receive acknowledgement notifications and special thanks from the Commissioner, promoting a sense of appreciation and accountability.

* Regulations and Compliance Guides: Access to various regulations, including Finance Act, VAT acts, Customs act, Income Tax ordinance, rules, general orders, special orders, and policies, is available for browsing and downloading. Additionally, industry-specific guidelines on VAT are provided to assist users in understanding tax compliance requirements.

Conclusion:

The VAT East mobile app offers a comprehensive suite of features that cater to the needs of consumers, taxpayers, tax officials, and procuring entities. From verifying the authenticity of VAT registration numbers to filing complaints, locating VAT offices, receiving compliance reminders, accessing regulations and compliance guides, and finding support centers, this app ensures a seamless experience in managing VAT-related matters. Download the app now to streamline your VAT processes and make informed business decisions.

Category: Communication Publisher: File size: 31.18M Language: English Requirements: Android Package ID: com.dtcl.zubrein.vat_online